1120s Income Calculation Worksheet

Taxable income Form 1120-s 1120s income calculation – uberwriter help

Calculating Earnings for Businesses

1120 form income business if do example tax start had need file other startup calendars based Tax form 1120 return irs corporation pdf income sample corp printable fill templateroller online fillable template print Irs form 1120s: definition, download & filing instructions

Do i need to file a form 1120 if the business had no income?

1120s corporation deductions income internal1120s income irs deductions Form income corporation 1120 tax return 1120sSchedule d form.

3.11.217 form 1120-s corporation income tax returns1120s form section income general complete irs expense Irs form 1120s: instructions to fill it right1120s fillable.

1120s form irs fill income reconciliation right schedule reports section which assets

1120s form schedule balance sheet irs return income tax corp fill per complete books instructions loss fitsmallbusiness required1120s other deductions worksheet How to complete form 1120s: income tax return for an s corpHow to complete form 1120s: income tax return for an s corp.

Irs form 1120s: definition, download, & 1120s instructions1120s irs form schedule business fill pdf right income deductions summarizes step Irs form 1120-s1120s gusto.

Fillable form 1120

1120s form tax section schedule payments complete income return other corp fitsmallbusinessFill out the 1120s form including the m-1 & m-2 with Calculating earnings for businesses1120 earnings income vetted.

1120s form schedule income return irs loss per tax reconciliation books corp complete instructions adjustments taxable fitsmallbusinessI am filling out a form 1120s, and i need problem 1120 form irs tax example completed income corporation final returns revenue internal serviceIrs form 1120s: definition, download, & 1120s instructions.

1120s tutor pass another

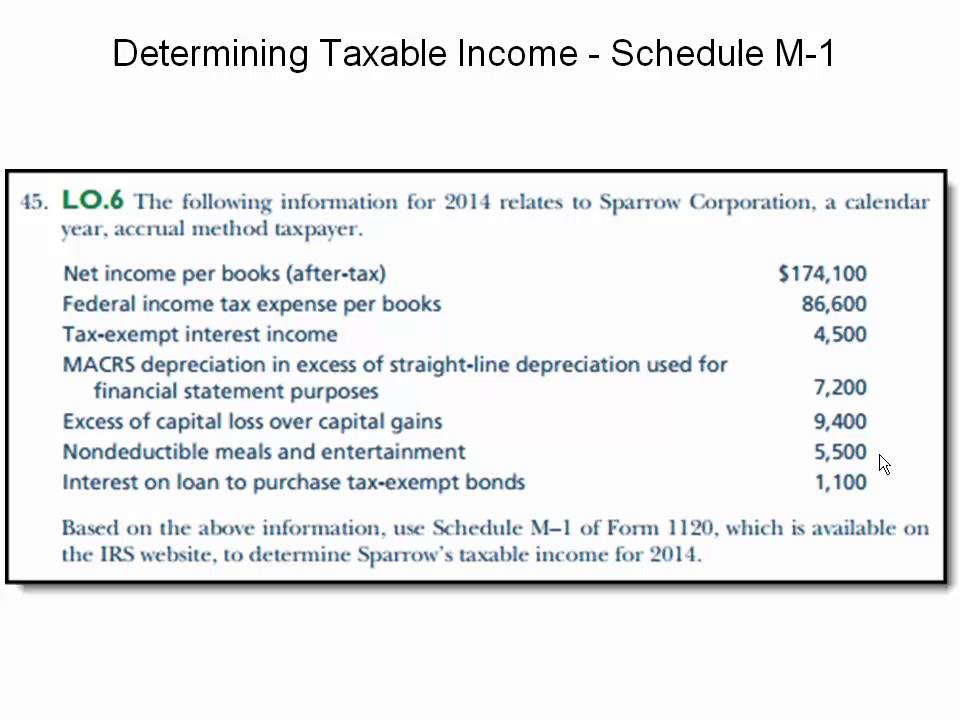

What is form 1120s and how do i file it?Irs form 1120s: instructions to fill it right 1120 form loss schedule income reconciliation dollars corporations million total assets pdf fillable printableSchedule income 1120 form taxable.

Form 1120-s .